The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

Wiki Article

About Custom Private Equity Asset Managers

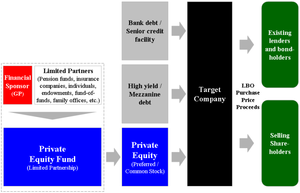

You've probably listened to of the term personal equity (PE): buying business that are not openly traded. Approximately $11. 7 trillion in properties were managed by exclusive markets in 2022. PE firms look for chances to earn returns that are better than what can be accomplished in public equity markets. Yet there may be a couple of things you do not understand regarding the industry.

Exclusive equity firms have an array of financial investment preferences.

Because the very best gravitate towards the larger deals, the middle market is a dramatically underserved market. There are a lot more vendors than there are highly seasoned and well-positioned money experts with comprehensive buyer networks and resources to handle a bargain. The returns of exclusive equity are typically seen after a few years.

The Best Strategy To Use For Custom Private Equity Asset Managers

Flying below the radar of big international firms, a lot of these little business official source commonly give higher-quality consumer service and/or particular niche product or services that are not being used by the large conglomerates (https://www.goodreads.com/user/show/172190636-madge-stiger). Such advantages attract the interest of exclusive equity companies, as they possess the understandings and smart to make use of such possibilities and take the firm to the following level

Private equity capitalists need to have trustworthy, capable, and dependable monitoring in location. Many managers at portfolio business are provided equity and perk payment structures that award them for striking their monetary targets. Such positioning of goals is generally required before a bargain obtains done. Exclusive equity chances are typically out of reach for people that can't invest millions of dollars, yet they should not be.

There are guidelines, such as restrictions on the accumulation amount of money and on the number of non-accredited financiers (Asset Management Group in Texas).

Custom Private Equity Asset Managers Can Be Fun For Anyone

Another drawback is the absence of liquidity; when in an exclusive equity purchase, it is challenging to leave or offer. There is a lack of adaptability. Personal equity additionally comes with high fees. With funds under management already in the trillions, personal equity companies have come to be appealing financial investment vehicles for rich people and institutions.

Now that access to exclusive equity is opening up to even more private investors, the untapped capacity is ending up being a truth. We'll start with the major debates for spending in private equity: Exactly how and why exclusive equity returns have traditionally been higher than various other properties on a number of levels, How including personal equity in a portfolio affects the risk-return account, by aiding to branch out against market and intermittent danger, Then, we will detail some crucial factors to consider and threats for personal equity financiers.

When it concerns introducing a brand-new asset right into a profile, the most basic factor to consider is the risk-return profile of that asset. Historically, personal equity has actually displayed returns comparable to that of Emerging Market Equities and greater than all other conventional property classes. Its fairly reduced volatility paired with its high returns creates an engaging risk-return profile.

The Best Strategy To Use For Custom Private Equity Asset Managers

In reality, private equity fund quartiles have the largest variety of returns across all different property courses - as you can see below. Approach: Inner price of return (IRR) spreads out determined for funds within classic years independently and afterwards balanced out. Typical IRR was determined bytaking the standard of the mean IRR for funds within each vintage year.

The impact of including exclusive equity into a profile is - as always - dependent on the portfolio itself. A Pantheon research study from 2015 suggested that consisting of exclusive equity in a profile of pure public equity can unlock 3.

On the various other hand, the very best personal equity firms have accessibility to an even larger pool of unknown opportunities that do not deal with the same scrutiny, in addition to the resources to perform due diligence on them and recognize which are worth buying (Private Equity Platform Investment). Spending at the first stage indicates greater risk, but for the business that do prosper, the fund gain from higher returns

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

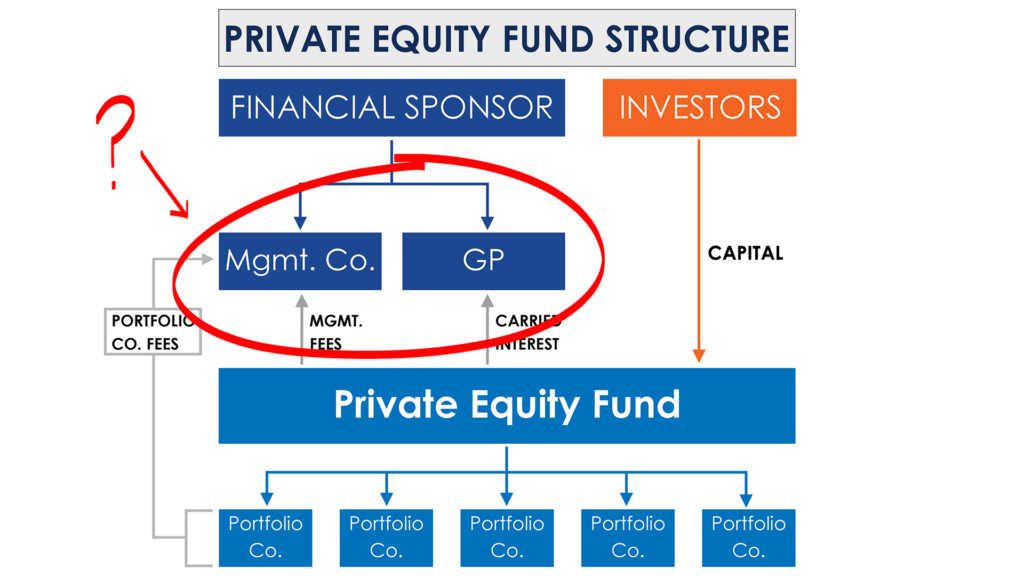

Both public and personal equity fund managers commit to spending a portion of the fund but there remains a well-trodden problem with lining up interests for public equity fund monitoring: the 'principal-agent trouble'. When a financier (the 'primary') works with a public fund supervisor to take control of their funding (as an 'agent') they pass on control to the manager while retaining ownership of the properties.

In the case of personal equity, the General Companion does not just make a management fee. Exclusive equity funds additionally reduce another form of principal-agent trouble.

A public equity investor ultimately desires one point - for the management to raise the stock cost and/or pay returns. The investor has little to no control over the choice. We showed above the amount of exclusive equity strategies - specifically majority buyouts - take control of the operating of the firm, making sure that the lasting value of the business precedes, raising the roi over the life of the fund.

Report this wiki page